kentucky transfer tax calculator

DOR has created a withholding tax calculator to assist employers in computing the correct amount of Kentucky withholding tax for employees. The calculator on this page is designed to help you estimate your projected long-term capital gains tax obligation based on the income made from your assets as well as the nuances of your financial circumstances.

Transfer Tax In Marin County California Who Pays What

Use our income tax calculator to find out what your take home pay will be in Oklahoma for the tax year.

. 2022 Employer Withholding Tax Calculator. Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc. These fees are separate from.

2022 W-4 Help for Sections 2 3 and 4. View balance only and make payments View all transactions and make payments View monthly student account statement. On average these expenses are usually 1 of the home sale price.

The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any. The 1098-T tax form is available electronically on myUK under Financials Account Services from the left-hand menu 1098-T Forms. Check for Social Security Withholding.

Kentucky Documentation Fees. Note that transfer tax rates are often described in terms of the amount of tax charged per 500. Use our income tax calculator to estimate how much youll owe in taxes.

If you have already registered and are ready to transfer your withholding information go to E-file and Payment Options in the top right hand corner of most of. Average DMV fees in Iowa on a new-car purchase add up to 354 1 which includes the title registration and plate fees shown above. Learn the specific estate planning documents you need to protect yourself and your loved ones.

12 tax on. Your average tax rate is 1198 and your marginal tax rate is 22. Local retailer fees on winnings from 100 to 500.

These are known as closing costs and include the cost of paying for title insurance escrow notary fee etc. Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc. Before Tax Cafeteria Plan Benefits.

10 tax on people who live 184 days a year in the country. The Undergraduate Net Price Calculator is a guide to help families plan for educational costs at Northern Kentucky University. If you live or earn money in one of the other 41 states or the District of Columbia you may need to file a state income tax return by the filing deadline.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for North Carolina residents only. It can calculate the gross price based on the net price and the tax rate or work the other way around as a reverse sales tax calculatorThe sales tax system in the United States is somewhat complicated as the rate is different depending on the state and. Your filing status determines which set of tax brackets are used to determine your income tax as well as your eligibility for a variety of tax deductions and credits.

This calculator will estimate your Expected Family Contribution EFC and serve as a resource for early financial planning based on 2022-2023 cost of attendance figures and student aid eligibility requirements. If you make 70000 a year living in the region of North Carolina USA you will be taxed 11498. Should you need assistance viewing your 1098-T visit myDocs Self-Service Document Portal.

Single - You are unmarried and have no dependants. Enter your details to estimate your salary after tax. Average DMV fees in Kentucky on a new-car purchase add up to 21 1 which includes the title registration and plate fees shown above.

30 tax on people who live less than 184 days a year in the country. Enter your income and other filing details to find out your tax burden for the year. It is a separate and independent.

Free Federal and State Paycheck Withholding Calculator. For example in Michigan state transfer taxes are levied at a rate of 375 for every 500 which translates to an effective tax rate of 075 375 500 075. All Credit Card Calculators.

Plan for your future today. These fees are separate from. The 1098-T tax form for 2021 is available electronically on your myUK account.

Married Filing Jointly - If you are married and are filing one joint return for both you and your spouse. This marginal tax rate means. 2022 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status.

It is not a substitute for the advice of an accountant or other tax professional. Iowa Documentation Fees. On myUK students may authorize a third party parent friend relative etc to access their student account to.

Transfer taxes are imposed by the local government to transfer ownership to the buyer. This online sales tax calculator solves multiple problems around the tax imposed on the sale of goods and services. Title Escrow Notary and Transfer Tax.

With the Social Security calculator you can not only figure out what your benefit will be when you retire but you can also use the information you Aug 16 2022 3 min read Leaving Money for College. As of 2021 the only states that do not charge a state income tax are Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming. Married Filing Separately - You are married and your spouse files.

Savings Future Value of Savings.

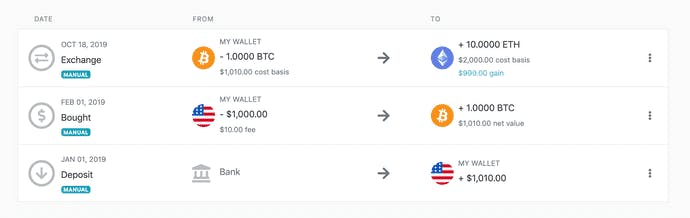

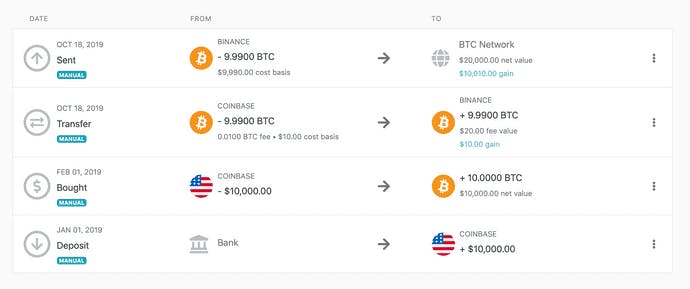

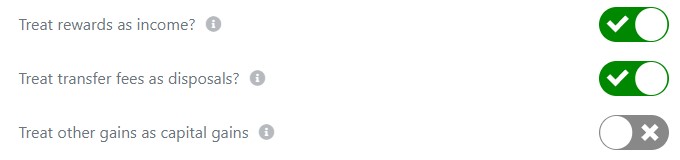

How Fees Can Lower Your Income Tax Koinly

How Fees Can Lower Your Income Tax Koinly

How Fees Can Lower Your Income Tax Koinly

Rental Property Roi And Cap Rate Calculator And Comparison Etsy Rental Property Rental Property Management Income Property

Single Touch Payroll Helps To Streamline Reporting And Transparent Process Payroll Accounting Software Crm Software

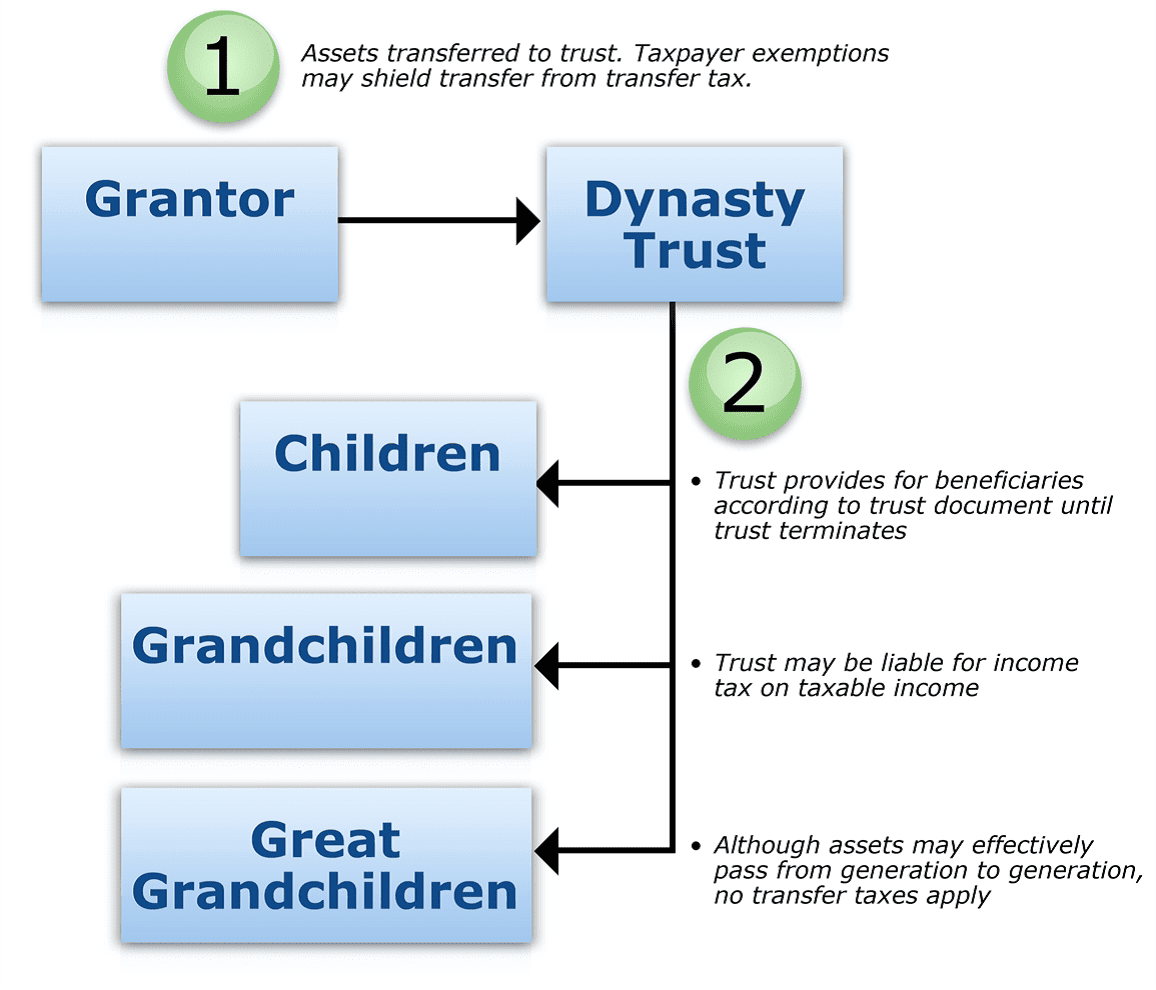

Is Your Legacy In A Dynast Trust Cwm

Buying A Home Isn T Just A 20 Down Payment And A Monthly Check For The Mortgage Here Are 9 Hidden Co Buying First Home Home Buying Checklist First Home Buyer

Credit Scores Explained Balance Transfer Credit Cards Paying Off Credit Cards Credit Card Payoff Plan

Transfer Tax In Marin County California Who Pays What

Transfer Tax In Marin County California Who Pays What

Buyers Don T Be Surprised By Closing Cost Real Estate Fun Real Estate Education Real Estate Infographic

How Fees Can Lower Your Income Tax Koinly

Annuity Beneficiaries Inheriting An Annuity After Death

Real Estate Facts You Need To Know Homesforsale Je Killeentexasrealty Com Selling House Real Estate Home Buying Process

Closing Costs Who Pays What When Buying Or Selling A Home Tilo Team Real Estate Closing Costs Selling House Home Repairs

How Fees Can Lower Your Income Tax Koinly

Nyc Nys Transfer Tax Hauseit Nyc Closing Costs Transfer

Buying A Home Isn T Just A 20 Down Payment And A Monthly Check For The Mortgage Here Are 9 Hidden Co Buying First Home Home Buying Checklist First Home Buyer