does binance send tax forms

Based exchanges such as Coinbase and Gemini will fill out IRS forms for you Binance only gives a list of all your trade history. Does binance provide tax forms.

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

If you earned at least 600 through staking or Learn and Earn rewards BinanceUS issues 1099-MISC s and reports to the IRS.

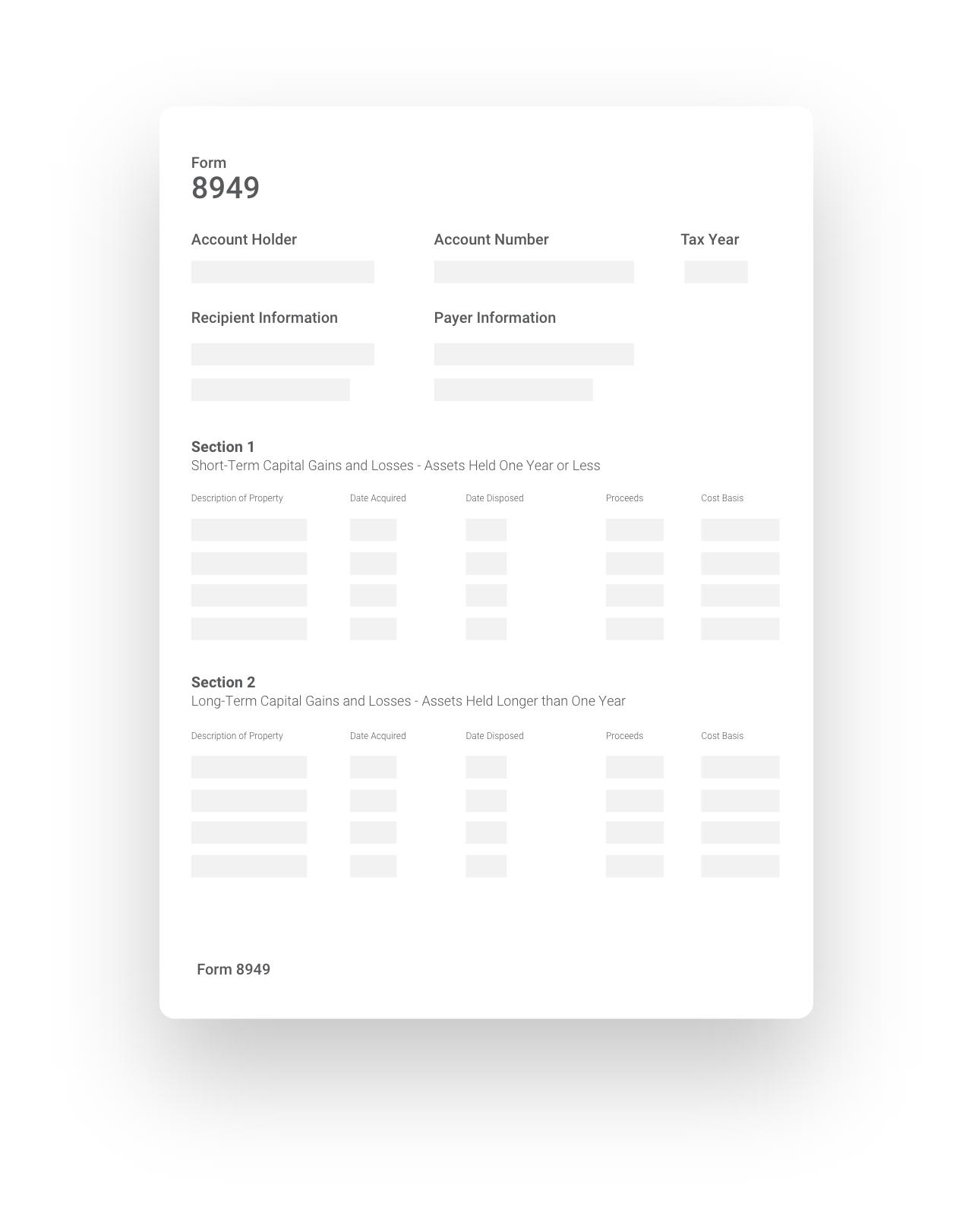

. This form provides information about miscellaneous income and does not include information about capital gains and losses from disposals which is needed to accurately. The companys Tax Information Reporting solution which has experience in handling tax issue in alternative currency markets allows BinanceUS to protect its users just as investors of other. File these crypto tax forms yourself send them to your tax professional or import them into your preferred tax filing software like turbotax or taxact.

Individual Income Tax Return requiring US. By law the exchange needs to keep extensive records of every transaction that takes place on the platform. Youll receive the 1099-MISC form from Coinbase if you are a US.

Theres two ways to generate a Binance tax form - manually or using a crypto tax app. Does binance report to tax. Form 1099-NEC is reported to the US IRS if a client or other business partner is a US person for tax purposes and has earned USD 600 or.

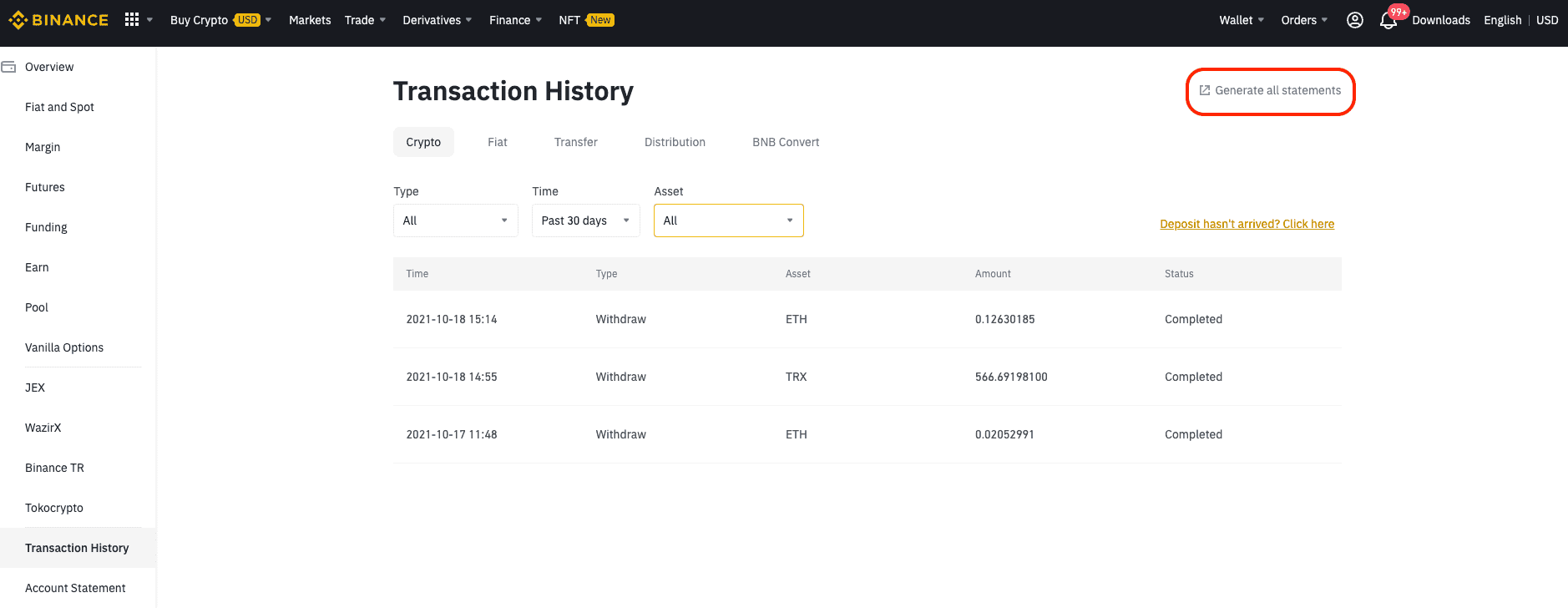

Please visit this page to learn more about it. Go to the Binance API page by hovering over the user icon in the top header and then click API Management. With Binance you are now able to have all your transactions tracked and accounted for automatically with our Tax Tool Functionality.

If you receive a Form 1099-B and do not report it the same principles apply. Although it previously issued certain traders 1099-Ks BinanceUS has discontinued the practice for tax years 2021 and beyond. Binance does not allow exporting your conversions so this must be added manually.

Likewise Coinbase Kraken Binanceus Gemini Uphold and other US exchanges do report to the IRS. File these crypto tax forms yourself send them to your tax professional or import them into your preferred tax filing software like TurboTax or TaxAct. After further evaluation and general indications from the IRS on the intended direction for future reporting BinanceUS has decided not to issue Forms 1099-K for customers on the exchange for the tax year 2021 and beyond.

For most states the threshold is set by the irs at 20000 usd and 200 transactions in a. Prepare your tax forms for Binance US. No they do not.

The IRS will receive a duplicate copy of your Form 1099-K. There are a few ways you can import your transactions to Coinpanda. Binance does not do much of the hard work for you when it comes to calculating your crypto.

As another example suppose you sell that ethereum for 4000 in bitcoin and then use that 4000 of bitcoin to buy a new car. When a customer earns more than 600 through staking referrals and other income-generating activities BinanceUS issues a Form 1099-MISC and files an identical copy with the IRS. Three of the main jurisdictions where this happens are the United Kingdom the United States and Canada.

Binance does not provide tax advice. This includes anytime you made a capital gain or loss by selling swapping spending or gifting crypto in most countries. While Coinbase doesnt issue 1099-Ks they do issue the 1099-MISC form and report it to the IRS.

Binance does not do much of the hard work for you when it comes to calculating. In 2019 the IRS introduced a mandatory check box on Form 1040 US. Please consult an outside tax professional for guidance on your personal tax obligations.

Taxpayers to answer yes or no to whether they had any crypto transactions during the year. If you expected to receive a Form 1099-K but didnt you probably only met one of the qualifications listed above not both. Click Get code to receive a verification code to your email address.

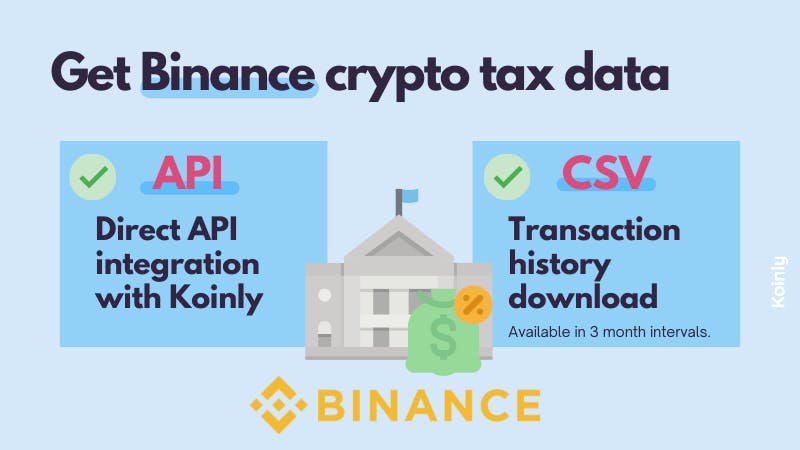

Binance US pairs with Koinly through API or CSV file import to make reporting your crypto taxes easy. We have integrated binance via api on beartax with which one can consolidate trades review depositsreferrals calculate capital gains and download tax forms within few minutes. Resident for tax purposes and earned 600 or more through staking USDC rewards and Coinbase Earn rewards which are all considered miscellaneous income.

If your account meets both of the above criteria BinanceUS will send you a Form 1099-K in January 2021 to your accounts address of record. Simply follow the steps below to get your API keys key secret and your tax forms will be. Click on Create Tax Report API.

I filed taxes and forgot to enter crypto gains. Binance gives you the option to export up to three months of trade. Binance Tax Reporting You can generate your gains losses and income tax reports from your Binance investing activity by connecting your account with CryptoTraderTax.

BinanceUS will use Sovos technology to automate its 1099 forms and filings which helps reduce potential human errors and ensure automatic regulatory updates. If youre doing it manually - your tax office want to know about all your taxable transactions on Binance. Therefore if you receive any tax form from an exchange the IRS already has a copy of it and you should definitely report it to avoid tax notices and penalties.

Binance does not do much of the hard work for you when it comes to calculating your crypto taxes. However this does not at all mean that the IRS cannot gain access to your BinanceUS transaction records. Based exchanges such as coinbase and gemini will fill out irs forms for you binance only gives a list of all your trade history.

They keep one copy for themselves send one copy to. This is the simplest way to synchronize all your trades and transactions automatically. 1099 form on your own or send them to your tax account assistant.

Once connected Koinly becomes the ultimate Binance US tax tool. The good news is while Binance US might not provide tax forms and documents Binance US does offer 2 easy ways to export transaction and trade history. Which Tax Documents Does Binance Give You.

Connect your account directly using API keys. These kinds of incomes are classified as ordinary income. Please utilize your transaction history to fulfil any local tax filing.

Yes Binance does provide tax info but you need to understand what this entails. Depending on the countrys regulatory framework when you trade commodities and the event produces capital gains or losses you would have to pay taxes duly. BinanceUS makes answering this requirement easier by providing you with your transaction history available to download.

A Form 1099-NEC is used to report certain income you might earn for services provided to Kraken between January 1st and December 31st each year. Enter the verification code and your 2FA code if required then click Submit. This means that no by default BinanceUS does not report to the IRS.

You can export all your history for 2020 as a CSV and calculate for yourself or import into a service that handles crypto taxes if you provide a CSV. Yes binance does provide tax info but you need to understand what this entails.

3 Steps To Calculate Binance Taxes 2022 Updated

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

The Complete Binance Tax Reporting Guide Koinly

What You Need To Know About The Binance Tax Reporting Tool Binance Blog

How To Connect Binance And Koinly

Taxbit Automate Your Cryptocurrency Tax Forms For Free

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

3 Steps To Calculate Binance Taxes 2022 Updated

3 Steps To Calculate Binance Taxes 2022 Updated

How The Irs Knows You Owe Crypto Bitcoin Taxes Cointracker

Binance Us Launches Tax Statements Portal And Joins Taxbit Network Taxbit Blog

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

3 Steps To Calculate Binance Taxes 2022 Updated

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

The Complete Binance Tax Reporting Guide Koinly

Binance Us Launches Tax Statements Portal And Joins Taxbit Network Taxbit Blog

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support